Beyond the FTE: Implementing Outcome-Based Pricing in the Agentic Era

For decades, the math of the Global Capability Center (GCC) was linear: More Revenue = More People. The "Full-Time Equivalent" (FTE) model was the gold standard. You rented intelligence by the hour.

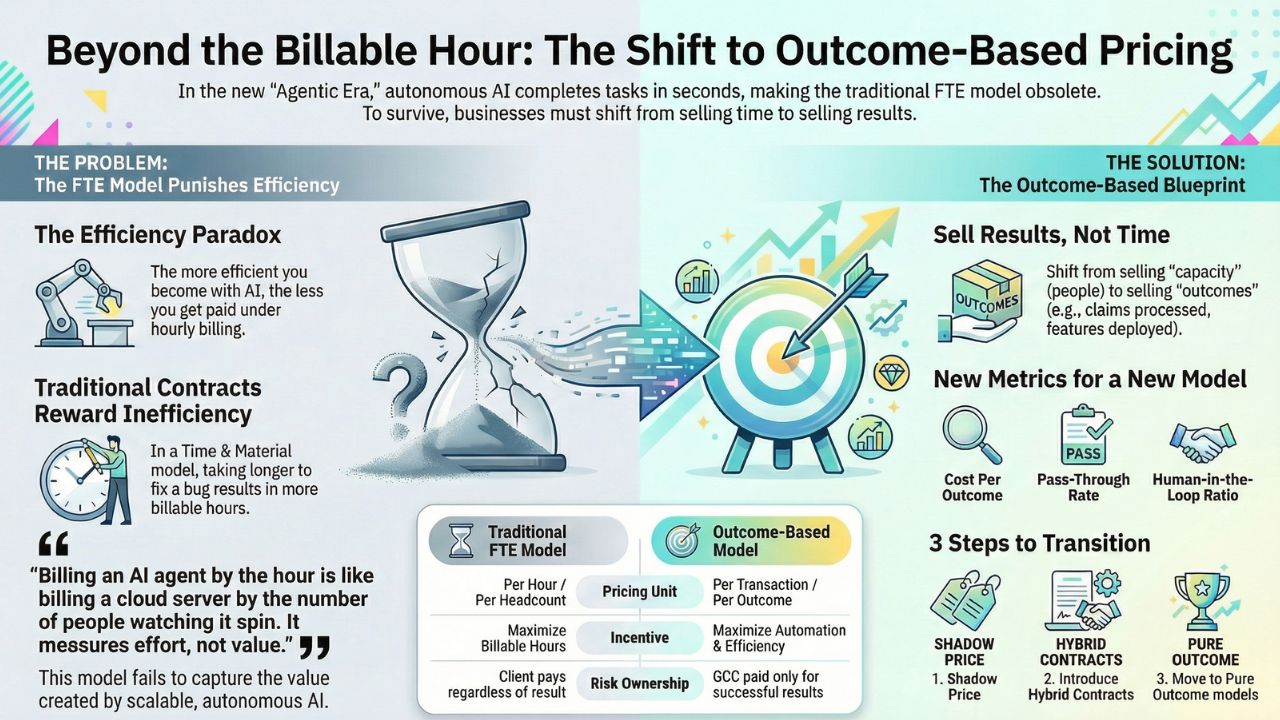

But what happens when the work that took a human 8 billable hours is completed by an autonomous agent in 8 seconds? If you are still billing by the hour, you have just destroyed your revenue model.

This is the central paradox of the Agentic Era: The more efficient you become, the less you get paid. To survive the transition to GCC 4.0, leaders must kill the FTE model and embrace Outcome-Based Pricing.

The Crisis of Efficiency: Why Hourly Billing is Dead

In a traditional Time & Material (T&M) contract, inefficiency is profitable. If a developer takes longer to fix a bug, the vendor bills more hours. There is no financial incentive to automate yourself out of a job.

AI Agents break this logic fundamentally. An Agentic Workflow doesn't get tired, doesn't clock out, and scales instantly.

GCCs that cling to "Headcount Growth" as a success metric are walking into a trap. As their parent organizations demand AI adoption, their billable hours will collapse. The only way out is to decouple revenue from time.

The Blueprint: Outcome-Based Commercial Models

The shift to Intelligence Arbitrage requires a new commercial contract. Instead of selling "capacity" (bodies in seats), GCCs must start selling "outcomes" (results delivered).

This requires a shift in measurement from SLAs (Service Level Agreements - e.g., uptime) to XLAs (Experience/Outcome Level Agreements - e.g., user satisfaction, revenue realized).

Comparison: FTE Model vs. Outcome Model

The following table illustrates how the metrics of success must change for Indian Captive Units and GCCs in 2026.

| Feature | Traditional FTE Model (GCC 1.0 - 3.0) | Outcome-Based Model (GCC 4.0) |

|---|---|---|

| Pricing Unit | Per Hour / Per Headcount | Per Transaction / Per Outcome |

| Incentive | Maximize Billable Hours (Inefficiency) | Maximize Automation (Efficiency) |

| Risk Ownership | Client pays for time regardless of result | Vendor/GCC only paid for successful result |

| Scalability | Linear (Need more people to grow) | Non-Linear (Scale via Compute/Agents) |

| AI Strategy | AI is a threat to revenue | AI is the engine of margin expansion |

Measuring Intelligence Arbitrage: The New KPIs

If you aren't counting heads, what do you count? The metrics for "Intelligence Arbitrage" focus on the leverage ratio between human oversight and digital output.

- Pass-Through Rate: The percentage of transactions (claims, tickets, invoices) processed by Agents without human intervention. (Target: >80%)

- Cost Per Outcome: The fully loaded cost to deliver one unit of value (e.g., $0.50 per claim processed vs $15.00 manually).

- Human-in-the-Loop Ratio: How many agents can one human supervisor manage effectively? (Moving from 1:10 to 1:100).

Strategic Next Steps for GCC Heads

You cannot flip a switch overnight. The transition to outcome-based pricing is a journey that starts with "Shadow Pricing."

Step 1: Shadow Pricing. Continue billing by FTE, but internally track what the bill would be if priced by outcome. This helps build the data baseline.

Step 2: Hybrid Contracts. Introduce a fixed base fee (to cover core infrastructure) plus a variable outcome fee.

Step 3: Pure Outcome. For mature agentic workflows (like L1 support or testing), move to 100% transaction-based pricing.

Back to Pillar: The Modern GCC 4.0 Explore the full Intelligence Arbitrage Hub Next Step: Operational Structure Read "Building the AI Control Tower"

FAQ: Outcome-Based Pricing

The FTE model relies on time spent (billable hours). AI agents reduce task time from hours to seconds. If you continue billing by time, your revenue collapses as your efficiency increases. The FTE model effectively punishes automation.

Instead of "hours worked," outcome metrics include: "Per Claim Processed" (Insurance), "Per Feature Deployed" (Software), "Per Incident Resolved" (IT Ops), or "Risk Percentage Mitigated" (Compliance).

Intelligence Arbitrage is measured by the ratio of Value Delivered to Human Headcount. If revenue or output grows non-linearly while headcount remains flat or decreases, you are successfully leveraging Intelligence Arbitrage.